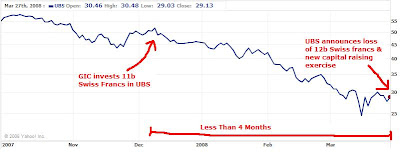

The Government of Singapore Investment Corp (GIC) is injecting 11 million Swiss francs, or nearly US$10 billion, into the troubled Swiss banking giant UBS.A few months later, on March 5th, 2008, the following was reported on many news sources, including reuters, about Jim Rogers' comments that Singapore was going to lose money on its investments in investment banks. (For those who don't know, Jim Rogers is one of the most successful investors of all time, and partnered George Soros when the two ran their Quantum Fund)

This will give GIC an almost 9 percent stake in UBS.

The deal comes as UBS announced that it was making further multi-billion dollar writedowns for its US sub-prime exposure.

"It grieves me to see what Singapore is doing. They are going to lose money," he added, referring to investments by Government of Singapore Investment Corp and Temasek in Citigroup, Switzerland's UBS and Merrill Lynch.Just today (April 1st, 2008) UBS has announced massive losses and is again trying to raise capital, just a few months after its massive capital raising exercise that involved GIC. Reuters reports:

UBS AG doubled its writedowns from the subprime crisis, parted company with its chairman and asked shareholders for more emergency capital on Tuesday in a second dramatic attempt to reverse its fortunes.But what is interesting about GIC's 'investment' is that UBS has been characterised as requesting more 'emergency capital' to 'reverse its fortunes'. I'm not sure I'd really put money in such a company and call it an investment.The Swiss bank wrote down an additional $19 billion on U.S. real estate and related assets, causing a net loss of 12 billion Swiss francs ($12.03 billion) in the first quarter, and said it would seek 15 billion francs through a rights issue of shares.

Well, of course, GIC and Temasek would say that their investments are 'for the long term' and that the performance of these investments cannot be evaluated simply on the basis of their performance in a few short months.

After all, a 40% drop in stock price in 4 months can't be that bad... right?

Well, in any case, it looks like Jim Rogers is far out in the lead in this race as to who will eventually turn out to be right (click for full images):

1 comment:

can you do a review on the ubs and citi investments? ie how much have they lost

Post a Comment