What do UBS AG, Merrill Lynch and Citigroup have in common?

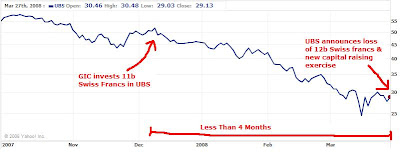

A. They're all banks which have received significant cash infusions from Singapore's Sovereign Wealth Funds, GIC and Temasek.

B. They're the 3 largest casualties of the ongoing credit crisis.

Behemoths of Mass ImplosionMeredith Whitney, one of the most prominent Wall Street bank stock analysts, recently

put out research notes either downgrading or cutting financial estimates for the three banks:

Merrill, rated “underperform,” faces “headwinds of deleveraging and the next disruptive step of restructuring.” ...

Ms. Whitney says she continues to “be negative in our outlook on Citigroup due simply to the fact that the company has seriously constrained earnings power, in addition to the writedowns seen in 2Q08,” which she estimates will hit $12.2-billion. ...

UBS is rated “underperform” by Oppenheimer because the Swiss bank “faces a difficult task of navigating through its risk exposures from the investment bank and rebuilding its damaged wealth management franchise.”

Whitney's pessimisim is not without good reason. UBS AG, Citigroup and Merrill Lynch, have been the banks with the largest total bank writedowns to date, far and ahead of the rest of their peers:

Citigroup leads the pack, with UBS and Merrill trailing close behind. But the gap between these three banks and the rest is extremely large - HSBC is the next closest with about half of Merrill's damage.

The same three banks lead in another key statistical metric: writedowns/market cap ratio:

This time, Merrill leads the charge. UBS and Citigroup fare better on this ratio, but still are way higher than the rest of the pack.

The stock markets have, in turn responded to the financial carnage the banks have inflicted on themselves: Merrill, Citigroup and UBS are amongst the top 5 % decliners in stock price:

Meanwhile, the 1-year performance of the stocks have indeed been nothing to envy:

The Dubious Wisdom of Lee Kuan Yew

The Dubious Wisdom of Lee Kuan YewLee Kuan Yew just a month ago

made some comments about GIC's splendid investments in Citigroup and UBS:

"The franchise of the banks, the expertise that they have, under proper leadership, they will be able to recover and rise again ... Will there be another Swiss bank like UBS for wealth management? I doubt it, we doubt it, that is why we invested in it." Citigroup, he added, had "an enormous spread worldwide as a retail bank".

These statements have indeed turned out to be questionable, if not downright wrong. UBS' 'unparalleled' wealth management franchise appears to be undergoing an unparalleled

tax evasion investigation:

UBS shares hit by talk of further losses, tax evasion case

Jun 23, 2008

ZURICH (AFP) — Shares in Swiss banking giant UBS plunged on Monday amid talk of further losses and as investors worried that a US tax evasion case around a former employee could widen to the bank itself.

At the close, UBS shares showed a fall of 4.42 percent to 22.06 Swiss francs on the Zurich stock exchange, after a loss of 3.27 percent on Friday. The overall market was down 0.60 percent.

In a note to investors, an analyst at Credit Suisse warned that UBS's wealth management could come under "significant pressure" if the tax evasion investigations broadens to a case directly impacting the bank.

"In a worst case scenario, UBS could lose its banking license which could have adverse effects on the global private banking franchise," she wrote.

On Sunday, Swiss newspaper Sonntag reported that US law enforcement officials had made a formal request to come to Switzerland to investigate a tax evasion case involving UBS.

The move has been sparked by the confession of former UBS banker Bradley Birkenfeld to a Florida court last week that he conspired to help US clients dodge millions of dollars in taxes.

Swiss officials from the justice and finance ministries have already travelled to Washington for talks with their US counterparts amid concern the case could damage the overall reputation of Switzerland's financial industry.

The subprime damage and the suspected tax evasion has had severe consequences for the top leadership of the bank:

UBS AG (UBS) was at the center of a tornado of crushing news Tuesday, as it announced major changes to its board amidst pressure from the U.S. Department of Justice to reveal the names of top clients taking advantage of the bank’s tax breaks.

Four of the No. 1 Swiss bank’s board members - Stephan Haeringer, Rolf Meyer, Peter Spuhler and Lawrence Weinbach - will step down at the bank’s Oct. 2 shareholder meeting.

...

The bank has been the biggest European casualty to the U.S. subprime-mortgage crisis. It has written down more than $38 billion in the last three quarters, and its stock has dropped more than 57% year-to-date.

Continuing that trend, the bank will likely post a second-quarter loss with another markdown of about $4.9 billion, according to Bloomberg News estimates.

UBS said it will immediately submit board-member recommendations to the governance committee and will explore redefining directors’ and management’s responsibilities.

So, not only has UBS taken a severe beating in the subprime mortgage crisis, its wealth management business is undergoing severe pressures as well.

How about Citigroup's "enormous spread worldwide as a retail bank"? Well, it seems that is

turning out to be a liability, rather than an asset.

Citigroup plans to sell $400 billion in assets

International Herald Tribune

By Eric Dash; Friday, May 9, 2008

Vikram Pandit is doing some serious spring cleaning at Citigroup.

Since becoming chief executive in December, Pandit has been clearing out the corporate attic of weak businesses and unloading worrisome assets at bargain-basement prices.

In an effort to streamline the sprawling company and placate restive shareholders, Pandit has sold or closed more than 45 branches in eight states. He has also disposed of Citigroup's headquarters building in Tokyo and its investment-banking base in New York and ditched more than $12.5 billion in loans used to finance corporate buyouts. And he has jettisoned the Diners Club credit card franchise, Citi's commercial leasing divisions and a big pension administration unit.

Pandit is not done yet. After months of false starts, Citigroup is now trying to sell Primerica Financial, a life insurance and mutual fund company, according to people close to the situation. He is also looking to sell its back-office outsourcing unit in India and its Smith Barney brokerage firm in Australia. Some speculate he also may try to sell 340 bank branches in Germany, possibly to Deutsche Bank.

On Friday, at Pandit's first major presentation to investors and analysts, Citigroup said that it planned to sell about $400 billion in assets in the next two to three years.

As it turns out, Vikram Pandit is trying to get rid of many of Citigroup's assets. Citigroup's worldwide sprawl made it a giant behemoth to big to manage. On top of that, Vikram Pandit has absolutely no experience running a consumer bank. Does Lee Kuan Yew really like such a person managing Citigroup's wide retail sprawl?

Suffering the ConsequencesWho is taking the brunt of all this financial damage? Ultimately, it is the shareholders of these banks. And although GIC and Temasek have incorporated some sort of short term guaranteed returns for their investments in the banks, ultimately, these investments will convert into equity and

suffer the effects of dilution:

Shareholders take brunt of banks' capital raising

Saturday June 21, 7:26 am ET

By Joe Bel Bruno, AP Business Writer

Banks cutting dividends, diluting shares to raise badly needed capital

NEW YORK (AP) -- America's banks and brokerages are scrambling to raise badly needed cash, but it may be at the expense of shareholders.

Since the subprime mortgage market imploded, financial companies caught in the fallout have been raising capital in two major ways -- cutting dividends and issuing more shares. Both methods erode shareholder value; analysts believe the industry is poised for more.

"The market is now seeing a substantial increase in financial companies issuing common and convertible instruments in an effort to shore up liquidity," said Standard & Poor's senior index analyst Howard Silverblatt. "The additional financing gives them immediate breathing room, with the payback being longer term dilution."

Put plainly, their gain is your pain.

Just this past week, Fifth Third Bancorp Chief Executive Kevin Kabat needed a cash infusion of $2 billion to bail out his struggling regional bank, while KeyCorp CEO Henry Meyer needed $1.5 billion. Both will issue stock to boost their balance sheets.

Banks have raised more than $60 billion this year by selling common and preferred shares.

The issuance of new stock acts to dilute the value of current shareholders because profit gets split among more shares. It's like having the family over for a turkey dinner and at the last minute grandpa invites the neighbors, too. There'll be less for everybody.

The end of the credit crisis is no where in sight, and the banks have yet to see the light at the end of the tunnel. And from how things are going right now, that light seems quite far away.

The writedowns at the banks have resulted in corresponding losses in stock price. And dilution of shareholders returns due to capital raisings only add to these woes. These are real losses that Singapore's SWFs will suffer; the supposed downside protection they built into their investments are but a short-term illusion.

Were these investments a good idea? We will only know for sure in a few years time when we have the benefit of 20/20 hindsight.

But the way things are going, the prospects for these investments simply don't look good at all.