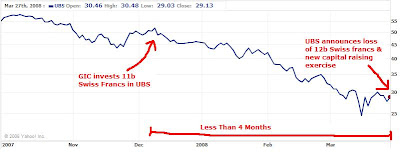

GIC a few months ago took significant stakes in global banking giants UBS and Citigroup. The share prices of these companies have since taken a tumble due to the impact of the credit crisis, but according to GIC, that's no worry, since GIC has taken these investments with a 'long term view.' In addition to GIC's existing investments in those banks, Lee Kuan Yew, Chairman of GIC and Minister Mentor of Singapore, has gone on the record as saying:

Singapore's GIC may invest in more banksAfter throwing in billions of dollars into credit-crunch battered financial institutions, Lee Kuan Yew is prepared to deploy more capital into this area. Ever confident about GIC's investments, the octogenarian further defended GIC's decisions:

Reuters, April 30

The Government of Singapore Investment Corp may invest in more banks in Europe and the United States if it gets the chance, adding to its stakes in beleaguered bank UBS and Citigroup, its chairman told Bloomberg TV.

"If there are other banks of the quality of the two that we bought into, with the promise and the capabilities and inherent capabilities to recover, we have got the liquidity to meet it, to make such an investment," Lee, 84, said in a Bloomberg Television interview late yesterday. "We will not rule it out."

"We are buying something that we intend to keep for the next two to three decades and grow with them", he said, adding that GIC was a long-term investor.

"The franchise of the banks, the expertise that they have, under proper leadership, they will be able to recover and rise again ... Will there be another Swiss bank like UBS for wealth management? I doubt it, we doubt it, that is why we invested in it." Citigroup, he added, had "an enormous spread worldwide as a retail bank".Interesting rationale. According to Lee Kuan Yew, UBS and Citigroup have "inherent capabilities to recover" from the credit crisis. Well, this is quite a debatable statement.

Just a few months after GIC's investments, recovery of the banking sector is far from sight. Instead, the banks are scrambling to raise more capital to deal with the damage the credit crunch has dealt them:

Citigroup, Merrill Lead Record Week of Bond OfferingsAn inherent ability to recover from the crisis? Not without a lot of additional capital - extra capital which is going to dilute your existing stakes.

By Bryan Keogh and Gabrielle Coppola

April 25 (Bloomberg) -- Citigroup Inc. and Merrill Lynch & Co. led $45.3 billion of U.S. corporate bond offerings, the busiest week on record, as financial companies sold debt at the highest yields since April 2001.

Sales compare with $31.2 billion last week and an average this year of $18 billion, according to data compiled by Bloomberg. Citigroup, the biggest U.S. bank by assets, sold $6 billion of hybrid bonds in the company's largest public debt offering, while New York-based securities firm Merrill Lynch raised $9.55 billion by issuing debt and preferred securities.

Bond offerings soared as investors grew more optimistic financial companies can recover from $309 billion of writedowns and credit losses tied to the collapse of the subprime-mortgage market. Banks and securities firms sold 85 percent of investment- grade debt this week, Bloomberg data show. High-yield bond issuance swelled to the most since November.

The debt issuance is not the end of the story. Citigroup is issuing equity as well:

Citigroup Sells $3 Billion of Stock to Boost CapitalCitigroup's issuance of equity financing is implicit acknowledgement that it won't be able to deal with the upcoming problems in the credit markets without substantial help. Add to that a weakening US economy and a looming recession, the clouds on the horizon are only getting darker.

By Bradley Keoun

April 29 (Bloomberg) -- Citigroup Inc., the U.S. bank hit with writedowns on subprime mortgages and bonds, is selling $3 billion of stock two weeks after reporting its second straight quarterly loss.

The shares are being sold in a public offering, New York- based Citigroup said today in a statement. Citigroup already has raised more than $30 billion of capital since December. A weakening U.S. economy and rising consumer delinquencies forced Chief Executive Officer Vikram Pandit to rescind assurances earlier this year that the bank didn't need to raise more funds.

"This was extremely disappointing," William Fitzpatrick, an equity analyst at Optique Capital Management in Racine, Wisconsin, said in a Bloomberg Television interview. "We were hoping they wouldn't have to go the equity markets like this."

Morgan Stanley realised this in its latest research report on the banking sector, painting a very bleak picture of the road ahead. This is in stark contrast to investors (including GIC) who have been calling an end to the banks' credit woes:

Morgan Stanley sees big bank woes just beginningJust for the record, a baseball game usually has nine(9) innings. Morgan Stanley's declaration that we are only in the third inning of the credit cycle, simply says we're not even a third of the way through the game. A Seeking Alpha contributor has also observed:

Monday April 28, By Joseph A. Giannone

NEW YORK (Reuters) - Morgan Stanley analysts on Monday told clients to "sell the rally" in financial stocks, slashing forecasts for big bank earnings and warning that the current credit crunch is only just beginning.

In aggregate, Morgan Stanley reduced its estimates for 2008 large bank earnings by $17 billion, or 26 percent, and reduced 2009 forecasts by $13 billion, or 15 percent. The analysts expect higher loan losses and expenses, offset by higher net interest income, though profits could fall further still if the Federal Reserve stops lowering interest rates.

"More capital hikes and dividend cuts (are) coming as our credit deteriorates and forward earnings decline," analysts led by Betsy Graseck wrote in a report. "We think we are only in the third inning of the credit cycle and expect this credit cycle will be worse than (the slump in) 1990-91."

The credit markets have improved, in terms of increased liquidity, with the Fed opening up the discount window for investment banks. However, the real economy, which has had only a minimal impact on the financial markets thus far, is deteriorating rapidly. Home prices are continuing to decline, costs of living are continuing to increase (look at the price of oil and food for examples), and the job market is reeling. The real economy will come back around and hit the financial institutions far harder than the freeze in the credit markets did. The Fed put out one fire, but threw gasoline on the other - through massive inflation - and we have not even begun to witness the effects this will have on our economy.Well, well, it appears Lee Kuan Yew doesn't seem so wise any more. Certainly not as wise as Warren Buffett, whose Berkshire Hathaway has stayed away from picking up stakes in these big banks. And its just as well that we clearly see the difference here, as GIC and Temasek have been repeatedly using slogans to "invest for the long term," to parade themselves as value investors of the Buffett kind.

But Lee Kuan Yew doesn't really understand Warren Buffett. He also said in the interview with Bloomberg:

'[Buffett] has a different view. He has to give returns to his investors year by year. We don't have to. We have to think in terms of the next 10, 20, 30 years. We are buying into something which we intend to keep for the next two, three decades and grow with them.'But I think anybody who knows Warren Buffett knows that Buffett's favourite investment horizon is forever, and that the investment legend has repeatedly stressed that Berkshire's focus is not on the quarter-to-quarter or year-to-year earnings. In all his writings to shareholders, one can clearly discern that Buffett has his eye on the long term future. Furthermore, Buffett's track record of consistently outperforming the market spans a good 50 years... Thus, for Lee to say the Buffett is narrowly focused on the year-to-year performance of his company, is to demonstrate a gross and fundamental misunderstanding of Buffett's investment philosophy - and thus it was ridiculous for Lee Kuan Yew to claim that GIC has significantly different obligations to its shareholders compared to Berkshire.

Finally, let's not forget Jim Rogers' warning to Singapore's Sovereign Wealth Funds earlier this year:

"It grieves me to see what Singapore is doing. They are going to lose money," he added, referring to investments by Government of Singapore Investment Corp and Temasek in Citigroup, Switzerland's UBS and Merrill Lynch.I think that just about sums up what is going to happen.