Friday, September 28, 2007

The Shin Saga: The Deal That Angered A Nation

An executive at Singapore's state-owned investment firm discusses the deal that triggered Thailand's political crisis. The company line: don't blame us.

Ex Chief Investment Officer of Temasek, Jimmy Phoon, gave an interview to newsweek. I must say his comments are quite frank and open. I wonder why Temasek didn't take this sort of attitude earlier.

Read the interview here

Tuesday, September 25, 2007

Willow Tree News/Temasek Watch Sep 25

- Thoughts on response to CPF speechfrom Siew Kum Hong

- CPF Reforms: Why Government's Critics Mostly Miss The Point

Monday, September 24, 2007

Jackson Tai to leave DBS

Said Tai: “Under my watch, DBS has established a sound platform for growth. Today, DBS has extended its geographic presence beyond Singapore with inroads into Hong Kong, China, India and Indonesia. I am confident the team will build on the strong momentum created in a resurgent Asia to further strengthen our position as a leading bank in this region.”

He added: “For more than eight years, I have dedicated myself to DBS and Singapore, even as my family remained in the States. There’s never a perfect time to leave but having been CEO for five years, I believe it’s now right for me to catch up with my family.”

This is certainly a surprising announcement that must be unexpected to many people. In fact, it seems that it is only now that DBS is starting to get its overseas growth plan going, having just emerged from the legacy of its expensive acquisition of Dao Heng bank and only just begun its official entry into the mainland Chinese banking market.

It is unlikely that Tai's departure has anything to do with the subprime crisis, of which DBS had little exposure. What seems more likely is that managing DBS's future is not exciting nor challenging enough for this former top investment banker to want to stay around in Singapore for the longer term. While it is true that Tai has established a platform for growth for the bank, there still is a lot to be done in terms of expanding the company's businesses in overseas markets; in many ways, Tai's successor will have his work cut out for him, to say the least.

But perhaps Tai's departure underscores DBS's difficulty in selecting the right talent to lead the company. Foreign candidates of Tai's calibre and experience may be lured to Singapore's shores for a period of time, but they will find it difficult to stay for the long term. Hanging around in Singapore for a few years may be an interesting experience, but the novelty wears off after a while.

In pursuing its global exective search for a new CEO, DBS may want to consider sacrificing international experience for someone who is more likely to stick around for the long term in order to give the bank a sense of continuity of leadership at the top. Constantly replacing CEOs without promoting from within makes the leadership disjointed, and top management has to constantly readjust and adapt to a new man or woman at the helm.

Of course, there is no better way to ensure continuity and consistency of leadership than by appointing someone who is homegrown and whom DBS can be sure of having his/her heart in Singapore.

Read DBS' press release here.

Air China may block SIA’s China Eastern purchase

If the rumours are true that Cathay & Air China are trying to block SIA's acquisition, then it will be interesting to see how Singapore's flagship airline reacts. And it will also be instructive to note that while SIA has a free, dominant reign at home, it receives absolutely no red carpet treatment once it ventures beyond the political influence of the PAP.

-----------------------

Air China may block SIA’s China Eastern purchase

The South China Morning Post reported on Saturday that Air China (753 HK, HK$11.84, NR) has accumulated an 11% stake in China Eastern’s H-shares (670 HK, HK$9.72, NR), from a mere 5% five months ago. Meanwhile, shares of Cathay Pacific (293 HK, NR) rose 10.7% on Friday to a record HK$22.70 before trading was suspended pending an announcement of a price-sensitive proposed transaction. Shares of Air China, China Eastern and China Southern (1055 HK, HK$13.90, NR) also rose.

While there is no official explanation from Air China on the nature of its share purchases in China Eastern, there is growing market talk that Air China and Cathay Pacific, both linked by a 17.5% cross-shareholding in each other, are uniting to block the SIA-Temasek joint bid for a 24% stake in China Eastern. This latest twist came as a surprise. If SIA is thwarted in its China ambitions, it may release cash to shareholders through special dividends, which will be positive for the share price in the near term.

The Air China-Cathay Pacific alliance is probably trying to fend off a potentially strong competitor from emerging in its own backyard. The deal, which will see SIA buy a 15.7% stake for HK$3.80 per H-share and Temasek buy an 8.3% stake, will require the approval of two-thirds of existing minority shareholders.

...

Impact on long-term growth. If SIA is thwarted, it may be prevented from developing its base in one of the world’s fastest-growing aviation markets, and this could negative implications for its long-term growth. SIA could also be more vulnerable to competition from Middle Eastern carriers on the lucrative kangaroo route as more capacity is deployed. However, SIA may still consider purchasing stakes in smaller privatelyowned airlines in China, and build the business slowly. We believe this is not its preferred strategy.

Read the rest of the CIMB research note here

Monday, September 17, 2007

Mid-September Review

CapitaCommercial & K-REIT

http://utwt.blogspot.com/2007

DBS, UOB & OCBC

http://utwt.blogspot.com/2007

Capitaland & City Developments

http://utwt.blogspot.com/2007

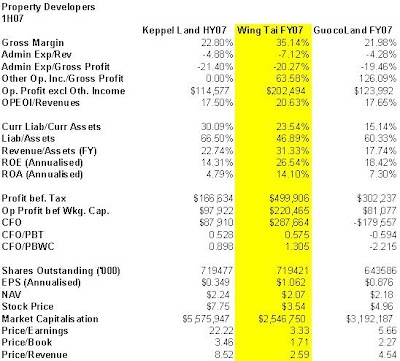

Keppel Land, Wing Tai & Guocoland

http://utwt.blogspot.com/2007

Finance Companies: Hong Leong Finance, Singapura Finance, Sing Inv & Fin

http://utwt.blogspot.com/2007

Insurers: Great Eastern, UOI, SHC Capital, Sing Re

http://utwt.blogspot.com/2007

Babcock & Brown Structured Finance Fund

http://utwt.blogspot.com/2007

Uni-Asia Finance Corp

http://utwt.blogspot.com/2007

United International Securities

http://utwt.blogspot.com/2007

Blackstone Group, in 2 parts

http://utwt.blogspot.com/2007

http://utwt.blogspot.com/2007

GMG Global (Rubber)

http://utwt.blogspot.com/2007

Liang Huat Aluminium

http://utwt.blogspot.com/2007

Blackstone Group (BX), Too Good to be True? – Part II

I certainly hope nobody bought the stock based on my calculation of 1.6x P/E, since it turns out that Blackstone is not trading at 1.6x P/E, but instead is trading at something very different. This goes to show you can't just follow other people's opinions, you need to do your own research. Check, check and double check. I can be and am wrong from time to time.

So, why the confusion?

Confusing Pattern of Disclosure

Below the reported income statement of Blackstone’s latest 10-Q, there is an indication of a weighted-average common units of 256m. This was the number used in the calculation of the firm’s P/E to give 1.6

This number, however, is rather misleading.

This number, however, is rather misleading. In order to get to the real number of units that you need to divide the earnings by, you need to look deep into the notes. The following extract was found on page 23 of the same 10-Q. Click for full image.

As we can see, there are another 827m units which will effectively vest themselves over time and which will have an equal claim on Blackstone’s earnings over the next few years. This brings the total effective number of units to 827m + 256m = 1084m which is 4.22x the number of common units.

For more on the same, the analyst will find information in the prospectus, as shown below:

This total of 1084m effective units gives BX an estimated P/E of 6.82, if the profits of the first six months of 07 are replicated in the 2nd half of the same year. This is very different from a P/E of 1.6 based on the 256m common units.

But, even though the company does actually disclose all the number of units actually outstanding, one must ask, why isn’t it more transparent? The number that should effectively be used is the 1b in units, not the 256m. The company could jolly well just state this number up front as it is the important number to be used in calculations. It should be disclosed in the main financial statements and not be left to the footnotes where users of the financial statements have to dig and delve. I can't help but feel a little suspicious over BX's attitude towards disclosure.

Economic Net Income:

Blackstone in its prospectus and 10-Q, frequently refers to an accounting measure which they call Economic Net Income. ENI represents Net Income excluding the impact of income taxes, non-cash charges related to the amortization of intangibles and the non-cash charges related to vesting of equity-based compensation.

A recent Merrill Lynch research report on BX from Wall Street based analyst Guy Moszkowski (who is supposed to be part of the All-America analyst team) claims, "GAAP earnings will be of very limited usefulness in evaluating BX performance given the massive non-cash Goodwill and compensation amortization costs GAAP will be saddled with for many years. The relevant question is, which of the adjusted figures is the "right" one for valuation of the company? In our view, ENI is best, since it captures the best-available view of the true value of the portfolio and the earnings it will yield over time"

The analyst also uses another measure which he calls distributable cash earnings, and claims the market can 'default' to cash: "Economic Net Income vs. Distributable Cash Earnings: conceptually, this adjusts ENI for non-cash earnings; ENI is conceptually, in our opinion, a better foundation for valuing the company than cash distributions, but for the time being we think the market will default to cash"

I personally have problems with these statements:

a. using a conceptually sound valuation model like the Residual Income model or the Abnormal Earnings Growth model will deal with the amortisation and compensation costs in the valuation

b. the cash based valuation and the accrual based valuation should theoretically converge in the long run, so i don't see how a market can 'default to cash'

In my opinion, ENI is not necessarily a superior measure of value. It is definitely a useful measure of performance, but not a suitable substitute for valuing the company. The prospectus does not go so far to claim that ENI is a superior measure of value for the company. Instead, it makes a sensible disclaimer that “ENI should not be considered in isolation or as an alternative to income before taxes in accordance with GAAP.”

In my opinion, ENI is not necessarily a superior measure of value. It is definitely a useful measure of performance, but not a suitable substitute for valuing the company. The prospectus does not go so far to claim that ENI is a superior measure of value for the company. Instead, it makes a sensible disclaimer that “ENI should not be considered in isolation or as an alternative to income before taxes in accordance with GAAP.” Whither the Credit Crunch?

Disregarding the confusion over the disclosure and the accounting issues surrounding the company, Blackstone still remains a strong business. It has made impressive returns and has an established track record, earning upwards of 30% IRR on its private equity deals before fees. Interestingly, a credit crunch would be a good thing for Blackstone. The IPO will give Blackstone billions of its own capital to finance its deals -- and it could even use its stock. This would certainly give the firm a big competitive advantage over other private equity firms which have chased and closed deals on poorer terms.

However, investors should note that the CEO of Blackstone, Steven Schwarzmann, cashed out on $800m during the IPO. As with any company, the price might be too high; initial investors in Blackstone’s IPO have discovered this to their detriment.

Blackstone will make a sensible investment, but only at a reasonable price. The current price of around $24 does not look too bad, but then again I think it could be cheaper. I’ll keep tabs on this company and write more when I can clarify the meaning of Economic Net Income and other accounting matters later.

Temasek Watch: The Struggle for ABN Continues

"The ABN Amro board told shareholders Sunday that although it is formally recommending neither a bid from Barclays nor a bid from a consortium led by Royal Bank of Scotland, it acknowledges the financial superiority of the latter offer. ABN CEO Rijkman Groenink told a Dutch news show he expects the consortium bid to win the day. The board said it views Barclays' all-share offer as more congruent with ABN's strategy but cannot recommend it over the consortium's €70.2 billion ($97.4 billion) bid, which is 19% richer at current prices and contains a cash component." read more @ SeekingAlpha.

Other News: Temasek pares down its stake in China COSCO.

http://www.bloomberg.com/apps/news?pid=20601209&sid=a.NpZ9rKuG6U&refer=transportation

Sunday, September 16, 2007

United International Securities

United International Securities Limited, through its subsidiary, United International Securities Trading (Private) Limited, engages in investment trading. It principally invests in quoted equities; quoted bonds, notes, and loan stocks; and unlisted equity shares, bonds, notes, loan stocks, and unit trusts. United International’s investment portfolio includes companies in the financials, industrials, consumer goods, healthcare, information technology, real estate investment trusts, materials, utilities, telecom services, and energy industries.

United International Securities Limited, through its subsidiary, United International Securities Trading (Private) Limited, engages in investment trading. It principally invests in quoted equities; quoted bonds, notes, and loan stocks; and unlisted equity shares, bonds, notes, loan stocks, and unit trusts. United International’s investment portfolio includes companies in the financials, industrials, consumer goods, healthcare, information technology, real estate investment trusts, materials, utilities, telecom services, and energy industries. The Company was incorporated in Singapore on 14 October 1969, as a wholly-owned subsidiary of Lee Wah Bank Ltd under the name of Lee Wah Enterprise (Pte) Ltd. On 18 September 1978, the Company changed to its present name.

The Company was incorporated in Singapore on 14 October 1969, as a wholly-owned subsidiary of Lee Wah Bank Ltd under the name of Lee Wah Enterprise (Pte) Ltd. On 18 September 1978, the Company changed to its present name.It was a dormant company until 11 September 1978 when the Company acquired a diversified portfolio of marketable securities and resumed its activities as an investment holding company. In October 1978, the Company offered 25 million shares of $1 each at par to the public. The United Overseas Bank group holds about 44 percent equity interest in UIS.

UIS in many ways resembles a mutual fund. It holds mainly marketable securities and does not own a majority stake in any business. All the securities are marked-to-market on the company’s balance sheet, and there is a weekly announcement of the company’s net tangible assets (NTA) via the SGX.

An interesting thing to note about UIS is that its stock has historically traded below NTA. For instance, the NTA per share of the company on 14 Sep 07 was $2.04. Yet UIS shares were traded at $1.75. Theoretically, one could acquire the company’s shares at $1.75 and liquidate the company’s balance sheet at an immediate profit of $0.29 per share.

So, why is UIS persistently trading at a discount to NTA? I am not sure why, but here are some arguments I can think for and against:

A. It is not practically possible for anyone to acquire UIS outright, other than UOB, which already holds 44% of the company. The discount to intrinsic value of the company would be extremely difficult to realize for the average shareholder. The directors of the company seem to understand that UIS is trading at a discount to NTA. The firm has therefore been making consistent buybacks of its shares. This benefits existing shareholders immediately. However, the fact that UIS makes such consistent buybacks indicates that they think UIS is undervalued by the market.

B. Another consideration is that one can theoretically replicate the portfolio of UIS through the open market without having to incur the operating expenses that UIS incurs. This means that the stock can never trade above NAV. However UIS does not make a full disclosure of its holdings, so investors in UIS are effectively delegating their funds to a fund manager.

C. Compared to mutual funds, the expense ratio (operating expenses/net assets) of UIS is slightly more than 1%, which is quite a low number compared to unit trusts which tend to charge about 2% management fees on assets under management. However, the purpose of investing in a mutual fund is to outperform the index. Otherwise, you might as well just stick your money in an index fund. How does UIS measure up?

Over the past 5 years investors UIS would have underperformed the STI. Over a slightly longer period of the last 8 years, investors in the STI would have underperformed UIS. However, UIS also pays out dividends and this is not reflected in the stock price. As I do not have longer term data, it is hard to put out the jury on which is the better performing investment.

Over the past 5 years investors UIS would have underperformed the STI. Over a slightly longer period of the last 8 years, investors in the STI would have underperformed UIS. However, UIS also pays out dividends and this is not reflected in the stock price. As I do not have longer term data, it is hard to put out the jury on which is the better performing investment. D. A further consideration is that UIS also invests in unit trusts. These unit trusts already pay their managers fees. Hence, a portion of UIS actually functions as a fund-of-funds. This is not particularly good for the investor as he is paying management fees twice around: once to the unit trust manager, and another time to the UIS management for selecting the funds to invest in.

D. A further consideration is that UIS also invests in unit trusts. These unit trusts already pay their managers fees. Hence, a portion of UIS actually functions as a fund-of-funds. This is not particularly good for the investor as he is paying management fees twice around: once to the unit trust manager, and another time to the UIS management for selecting the funds to invest in.E. Yet another consideration is that the fund's portfolio is heavily concentrated in certain sectors. 42% of the fund is in financials and another 20% is in industrials. This is not exactly a highly diversified fund.

Conclusions

ConclusionsAs the entire holdings of UIS are not disclosed, and as it is not clear what the investment mandate of the company is, I am not sure that there is a compelling reason to invest in UIS. Furthermore, I am still struggling to understand why UIS trades at such a significant discount to NTA when it has mostly marketable securities and other liquid assets on its balance sheet.

For me, the jury is still out on this stock and I would be glad if readers would offer their opinions regarding this stock. To me, it still seems wiser to simply stick your assets into an index fund which is more highly diversified and has an even lower expense ratio.

Thursday, September 13, 2007

Insurers: Great Eastern, UOI, SHC Capital, and Sing Re

Apart from these big players, there is the smaller UOI, which is part of Wee Cho Yaw's UOB Bank Group, and the tiny SHC Capital, a struggling insurance player. In the reinsurance market, the only local player in Singapore Reinsurance.

The big boys naturally dominate the market with their size and established distribution and marketing network. The smaller players like UOI have to participate in the niche markets such as construction and marine insurance. For instance, UOI markets its property insurance when UOL launches its projects.

As can be seen above, SHC Cap has the worst ROE. It has been struggling for a while and has been taking losses in past years, only recently turning to profitability, and even then its profitability is weak. Great Eastern is by far the biggest in size.

As can be seen above, SHC Cap has the worst ROE. It has been struggling for a while and has been taking losses in past years, only recently turning to profitability, and even then its profitability is weak. Great Eastern is by far the biggest in size.The other insurance players have reasonably strong numbers. However it must be noted that many of the insurers recorded significant gains from investments due to the buoyant equity markets. The earnings derived from these gains may not persistent.

Valuation wise it looks like UOI may be slightly undervalued. It is returning a reasonable ROE but yet is priced below book and very conservatively in terms of P/E. Even adjusting for the gains from investments, UOI still looks conservatively priced.

I am not going to do a much deeper analysis of this industry. I tried to adjust the income statements into a comparable basis but the reporting standards are quite different for the three insurance players. In addition they are very different in size and compete in very different ways.

Nevertheless, this brief snapshot is useful for future reference.

Global Alpha, or Global Omega?

In news just out, Goldman's quant fund, Global Alpha, was down 22% in August 07, and down 33% year-to-date and 44% from its March 2006 peak. The company's trades, which are based on mathematical formulae, are going terribly awry.

Even with such heavy losses, the fund managers are resolutely holding on to their beliefs in their mathematical formulae:

"We still hold our fundamental investment beliefs that sound economic investment principles coupled with a disciplined quantitative approach can provide strong uncorrelated returns over time,"At the same time, "Goldman blamed its losses on too many quantitative funds making the same trades, and said in mid-August it would have to develop new strategies."

The same thoughts are probably running through the minds of other quantitative hedge fund managers which trade the markets based on a quantitative approach. Even with their losses they probably still hold to their 'fundamental investment beliefs.'

However, even though these hedge fund managers are probably super-smart and have ultra-high IQs, it means little when there are also other super-smart fund managers pursuing the same strategies. When markets turn against them, their computers simultaneously take the same cut-loss strategies, causing the market to move much more than expected and causing massive losses.

At the end of the day, I do not think that it is necessary to be a super-smart high-IQ individual to beat the market. You just need to think in a Contrarian manner - when the crowd is rushing towards the exits, that is the time to be buying. When the crowd is rushing in, it is time to get out.

And the good news is, Contrarian Investing has very little to do with intellect and IQ, it has much to do with emotional discipline. It has to do with doing your own home work, thinking for yourself, and having the courage to stand against the crowd.

And guess what, if you are contrarian, you will never run into the problem where there are "too many quantitative funds making the same trades," because you'll be making the kinds of decisions that few others are making.

Be a Contrarian today.

Wednesday, September 12, 2007

Blackstone Group (BX) – Too Good to be True?

Overview

Blackstone Group is a recently listed American company that is active in the private equity business. Private equity companies are in the business of buying businesses and selling them later at a profit. Often, the acquisition targets of private equity companies are underperforming public companies. For instance, Cerberus Capital Management recently acquired struggling automaker Chrysler from Daimler Chrysler, in a bid to turn the business around and later sell it at a profit.

Blackstone Group is a recently listed American company that is active in the private equity business. Private equity companies are in the business of buying businesses and selling them later at a profit. Often, the acquisition targets of private equity companies are underperforming public companies. For instance, Cerberus Capital Management recently acquired struggling automaker Chrysler from Daimler Chrysler, in a bid to turn the business around and later sell it at a profit.

Blackstone was recently in the news as one of the first

A friend of mine recently gave me a call to ask what my opinion of the stock was. Blackstone’s stock has recently fallen from its post-IPO high of around $35 and is currently trading at around $23. The most recent half-year results indicate that Blackstone’s earnings grew at a tremendous rate: HY07 earnings are 2.67x that of HY06 earnings. Furthermore, if we double HY07 earnings for a full year estimate, the current stock price gives a FY07 P/E of only 1.6! Indeed, at first glance, Blackstone may appear to be a value investor’s dream.

A deeper examination of the situation, however, may shed light on why the market is pessimistically valuing a company with such stellar results.

A deeper examination of the situation, however, may shed light on why the market is pessimistically valuing a company with such stellar results. Lumpy Business Model - Blackstone’s corporate private equity and real estate businesses have benefited from high levels of activity in the last few years. These activity levels may continue, but could decline at any time because of factors out of management’s control. While the long-term growth trends in Blackstone’s businesses are favorable, there may be significant fluctuations in our financial results from quarter to quarter.

Use of Leverage to Enhance Returns - In order to generate enhanced returns on equity, Blackstone has historically employed significant leverage on its balance sheet. As a public company, Blackstone intends to continue using leverage to create the most efficient capital structure for Blackstone and its public common unitholders. Blackstone anticipates that its debt-to-equity ratio will eventually rise to levels in the range of 3:1 to 4:1 as it attempts to increase its return on equity for the benefit of common unitholders. This strategy will expose Blackstone to the typical risks associated with the use of substantial leverage, including affecting the credit ratings that may be assigned to Blackstone’s debt by rating agencies. Blackstone’s use of leverage to finance its business will expose us to substantial risks, which are exacerbated by our funds' use of leverage to finance investments".

Volatile Activity According to Economic Conditions - Blackstone focuses closely on actual and expected changes in the economic conditions and conditions in the debt and equity capital markets in all of the geographic regions in which it conducts business, and the company tries to accelerate or reduce (or on occasion suspend entirely) the rate of its investment—or disposition—activities in response to changing economic and market conditions. In the past, changing economic and market conditions and Blackstone’s investment actions in response to those changes have led to swings in investment activity from year to year. Blackstone expects these swings to occur in future years as well, which is one of the reasons why there may be significant volatility in revenue, net income and cash flow.

Impact of Tightening credit

Decreased Liquidity and Higher Cost of Credit - Widening credit spreads as precipitated by the subprime correction mean that the easy credit that fueled leveraged buyouts and private equity acquisitions is no longer as freely available as it was. This means that in the months ahead, Blackstone will find it more challenging that in to find the financing to pursue its deals than it did in previous years where liquidity was easily available at a low cost of debt. At the same time, the higher cost of credit will mean that Blackstone will probably have to pay higher interest rates on its financing. This narrows the field of acquisition candidates because hurdle rates have risen and the standard of cash flows that acquisitions generate will have to be higher than before.

Higher interest costs on existing acquisitions – Existing deals may be subject to higher debt servicing costs and this will eat into the profitability of the firms of which Blackstone has taken private. This in turn will have an impact on the investment returns of the private equity investments and the fees and revenues due to the firm. Furthermore, the higher cost of debt increases the probability default. This risk is especially pertinent since private equity firms tend to take on significant leverage at high yields in order to fund their acquisitions.

Decreased deal flow – Blackstone gets a significant amount of revenues from deal advisory fees. The impact of higher credit spreads on a lower deal flow will see a decline in advisory revenues and fees.

Valuation

At a valuation of 1.6 P/E, probably indicates that the market thinks that HY07’s earnings are at a cyclical peak and that earnings will fall in the periods ahead. The question is, how much will the earnings fall by and is the current valuation overly pessimistic?

A proper valuation will probably have to involve a DCF/NPV valuation projecting the financials taking into consideration current conditions in the credit markets and the possibility of a

Appended below are extracts from Blackstone’s prospectus particularly pertinent to the valuation problem at hand.

-----------------------------

Difficult market conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our investment funds, reducing the ability of our investment funds to raise or deploy capital and reducing the volume of the transactions involving our financial advisory business, each of which could materially reduce our revenue and cash flow and adversely affect our financial condition.

Our business is materially affected by conditions in the global financial markets and economic conditions throughout the world that are outside our control, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws (including laws relating to taxation), trade barriers, commodity prices, currency exchange rates and controls and national and international political circumstances (including wars, terrorist acts or security operations). These factors may affect the level and volatility of securities prices and the liquidity and the value of investments, and we may not be able to or may choose not to manage our exposure to these market conditions. The market conditions surrounding each of our businesses, and in particular our corporate private equity and real estate segments, have been quite favorable for a number of years. Future market conditions may not continue to be as favorable. In the event of a market downturn, each of our businesses could be affected in different ways. Our profitability may also be adversely affected by our fixed costs and the possibility that we would be unable to scale back other costs within a time frame sufficient to match any decreases in revenue relating to changes in market and economic conditions.

Our investment funds may be affected by reduced opportunities to exit and realize value from their investments and by the fact that we may not be able to find suitable investments for the investment funds to effectively deploy capital, which could adversely affect our ability to raise new funds. During periods of difficult market conditions or slowdowns in a particular sector, companies in which we invest may experience decreased revenues, financial losses, difficulty in obtaining access to financing and increased funding costs. During such periods, these companies may also have difficulty in expanding their businesses and operations and be unable to meet their debt service obligations or other expenses as they become due, including expenses payable to us. In addition, during periods of adverse economic conditions, we may have difficulty accessing financial markets, which could make it more difficult or impossible for us to obtain funding for additional investments and harm our assets under management and operating results. A general market downturn, or a specific market dislocation, may result in lower investment returns for our investment funds, which would adversely affect our revenues. Furthermore, such conditions would also increase the risk of default with respect to investments held by our investment funds that have significant debt investments, such as our mezzanine funds, senior debt vehicles and distressed securities hedge fund.

In addition, our financial advisory business would be materially affected by conditions in the global financial markets and economic conditions throughout the world. For example, revenue generated by our financial advisory business is directly related to the volume and value of the transactions in which we are involved. During periods of unfavorable market or economic conditions, the volume and value of mergers and acquisitions transactions may decrease, thereby reducing the demand for our financial advisory services and increasing price competition among financial services companies seeking such engagements.

Our revenue, net income and cash flow are all highly variable, which may make it difficult for us to achieve steady earnings growth on a quarterly basis and may cause the price of our common units to decline.

Our revenue, net income and cash flow are all highly variable, primarily due to the fact that we receive carried interest from our carry funds only when investments are realized and transaction fees received by our carry funds and fees received by our advisory business can vary significantly from quarter to quarter. In addition, the investment return profiles of most of our investment funds are volatile. We may also experience fluctuations in our results from quarter to quarter due to a number of other factors, including changes in the values of our funds' investments, changes in the amount of distributions, dividends or interest paid in respect of investments, changes in our operating expenses, the degree to which we encounter competition and general economic and market conditions. Such variability may lead to volatility in the trading price of our common units and cause our results for a particular period not to be indicative of our performance in a future period. It may be difficult for us to achieve steady growth in net income and cash flow on a quarterly basis, which could in turn lead to large adverse movements in the price of our common units or increased volatility in our common unit price generally.

The timing and receipt of carried interest generated by our carry funds is uncertain and will contribute to the volatility of our results. Carried interest depends on our carry funds' performance and opportunities for realizing gains, which may be limited. It takes a substantial period of time to identify attractive investment opportunities, to raise all the funds needed to make an investment and then to realize the cash value (or other proceeds) of an investment through a sale, public offering, recapitalization or other exit. Even if an investment proves to be profitable, it may be several years before any profits can be realized in cash (or other proceeds). We cannot predict when, or if, any realization of investments will occur. If we were to have a realization event in a particular quarter, it may have a significant impact on our results for that particular quarter which may not be replicated in subsequent quarters. We recognize revenue on investments in our investment funds based on our allocable share of realized and unrealized gains (or losses) reported by such investment funds, and a decline in realized or unrealized gains, or an increase in realized or unrealized losses, would adversely affect our revenue, which could further increase the volatility of our quarterly results.

With respect to our proprietary hedge funds and many of our funds of hedge funds, our incentive fees are paid annually, semi-annually or quarterly if the net asset value of a fund has increased. Our hedge funds also have "high water marks" whereby we do not earn incentive fees during a particular period even though the fund had positive returns in such period as a result of losses in prior periods. If a hedge fund experiences losses, we will not be able to earn incentive fees from the fund until it surpasses the previous high water mark. The incentive fees we earn are therefore dependent on the net asset value of the hedge fund, which could lead to significant volatility in our quarterly results.

We also earn a portion of our revenue from financial advisory engagements, and in many cases we are not paid until the successful consummation of the underlying transaction, restructuring or closing of the fund. As a result, our financial advisory revenue is highly dependent on market conditions and the decisions and actions of our clients, interested third parties and governmental authorities. If a transaction, restructuring or funding is not consummated, we often do not receive any financial advisory fees other than the reimbursement of certain out-of-pocket expenses, despite the fact that we may have devoted considerable resources to these transactions.

Tuesday, September 11, 2007

Developers: Keppel Land, Wing Tai Holdings & GuocoLand

Overview

Of the three,

Of the three,

Nevertheless, it is currently partnering with Hong Kong Land (subsidiary of Jardine Matheson) and Cheung Kong Holdings (controlled by Li Ka Shing) to develop two of the newest and sexiest commercial developments, the Marine Bay Financial Centre and One Raffles Quay. On the residential side, Keppel has recently launched several upscale projects such as the Reflections at

Wing Tai Holdings is somewhat smaller than Keppel, but large nevertheless in terms of absolute revenue. It is a player mainly in the residential and hospitality markets. The group’s operations have mainly been in

GuocoLand is a subsidiary of Hong Leong Group Malaysia, run by billionaire Quek Leng Chan, cousin of Kwek Leng Beng.  Its developments tend to be condominiums in the residential areas in

Its developments tend to be condominiums in the residential areas in

Competitively, Wing Tai’s and Guoco’s market positioning is slightly different from the Keppel/CDL/CapitaLand group which focuses on large scale mega projects. On the other hand, Wing Tai and Guoco compete mainly in the mid to upper-tier residential market with condos and smaller upscale developments.

As is widely known, the macroeconomic environment is favourable overall, with many property players seeing large upside revaluations on their assets and a healthy environment with which to launch their new projects. This favourable environment is seen by most to be able to sustain itself for the mid-term future in all the key markets in which the businesses compete:

Financial Statement Analysis

In terms of disclosure, Keppel Land is far and away the most transparent and analyst-friendly. And considering that it is only their HY07 financial results, this is quite remarkable. Keppel provides a lengthy Management Discussion & Analysis of the operating environment, as well as detailed segmental reporting. The other two companies provide less of such information in their FY07 report. It is presumed that more information will be disclosed in their respective annual reports.

The table below displays the comparative Jun 07 results for the three companies. Wing Tai and GuocoLand report FY07 results in June. These are compared against Keppel’s HY07.

It should be noted that both Wing Tai and GuocoLand have registered significant gains due to revaluations in assets. The recording of revaluation gain in the income statement is brought about by the adoption of the accounting standard FRS 40. Prior to this standard, revaluation gains were recorded directly on the balance sheet as other comprehensive income. The earnings presistence of these gains is comparatively low and should not be treated as core income.

Just as for the property majors, I use an adjusted number, operating profit excluding other income, in order to adjust for the property revaluation income. The OPEOI/Revenues are more comparable, with Wing Tai registering a few percentage points higher in this margin. It is also notable that Wing Tai employs significantly less leverage than the other two developers.

Valuation

In terms of valuation, it can be seen than the P/E and P/B of Wing Tai is much smaller than its peers. This is probably due to large revaluation gains it has registered. Also, it could be due to the smaller pipeline of projects that Wing Tai has, compared to the mega projects of Keppel. The balance sheet space for additional leverage could indicate that Wing Tai does not have as many projects as it could have, in order to maximise the utilization of its balance sheet.

Guocoland is priced somewhere in the middle.

It is difficult to say if any of these companies are over or undervalued, without a deeper and more detailed financial analysis of the development pipelines of the respective companies. Nevertheless, this overview is sufficient to give an overall feel for this segment of the industry and how it operates.

Monday, September 10, 2007

The Economics and Politics of the CPF

Q: Whats your opinion about CPF 2.5 % and 4 % per annum? Are the returns fair for the avg singaporeans? I thought CPF as an institution ($60 bn, correct me if i'm wrong), should have economies of scale when engaging with investment banks and hence better returns if it were to engage with Vanguard or Merrill Lynch.

...

I think the real question for CPF should always be about economic/financial viability and nothing to do with politics. Investment is something we can calculate/evaluate that is why i love it, can we evaluate politics?

A:The Ministry of Finance (MoF) manages and controls the CPF. It takes in monies/deposits from Singaporeans on the liabilities side while investing the proceeds on the assets side.

On the assets side, Temasek and GIC, which are owned by the ministry of finance, manage the reserves and investments of the MoF.

Now, the challenge for the ministry of finance is to give Singaporeans a reasonable return on their CPF monies, at the same time guaranteeing that

A. it will be there for their retirement, and also guaranteeing that

B. it will be available for housing and medisave,

as and when it is needed for those purposes.

The crux is, how much return should Singaporeans get on their CPF savings, while still being able to retain benefits (A.) and (B.)

Your contention is that it should be possible for the government to give a higher return than a 4% fixed rate. After all, if you were just managing your own retirement money, you would just put your savings into an index fund and let it sit for 30yrs and you would expect to earn about 9% per annum. So, why can't the government do this, since because of its size it has a large bargaining power and it can rope in world class investment expertise from around the world?

My argument is that, yes, it may be possible for the government to give higher rates, but with several caveats.

a. Size is the enemy of returns. Even the Sage of Omaha, Warren Buffett, has admitted that the mountain of capital he has to deploy eats away at his returns. On an individual's scale, you may be managing your retirement money of $1 million. However, this is a very different problem compared to managing assets of $60b. The MoF/CPF cannot simply stick all its assets into an index fund like you can. We have to note that from the government's point of view it is taking responsibility for the entire country and the problems are quite different on a macro scale rather than the micro scale of the individual.

b. Many Singaporeans intend to use their CPF for housing and Medisave. This adds a liquidity challenge to the investment issue and the government may only be able to deal with this by devoting a significant portion to shorter-term marketable liquid securities which give a much lower return than equities. At the same time, higher returns tend to be made in long term investments such as corporate acquisitions, real estate, and equities which will be much more volatile and illiquid than fixed-income securities. Therefore, in order to provide the liquidity and certainty (benefits A. and B. as discussed above), the Ministry of finance may not be able to devote a large portion of CPF monies into higher yielding investments, therefore the tradeoff is that Singaporeans have to accept lower returns on their CPF monies than if they were managing their retirement themselves.

Since we do not have empirical information about the size of the CPF and the inflows and outflows of CPF monies and the investments of the MoF, we can only speculate whether or not 4% is a reasonable number.

This covers the economics and finance of the CPF issue.

The politics of the CPF, however, is just as important.

Central to the CPF is the idea that Singaporeans should automatically abdicate their rights (and responsibilities) to manage their own retirement money, to the government. This is enshrined in the fact that CPF is compulsory for all Singaporeans.

If Singaporeans accept the compulsory nature of the CPF and take no political action to the contrary, then they have to also accept whatever it is that the government gives them. After all, if you don't want to take responsibility for your own retirement, then you have no say in determining the return on your retirement monies. In other words, if you let the govt manage your money, then you have to accept whatever the govt gives you, 4% or not.

And, if the govt is able to invest the money at 15% (thru its investment arm like Temasek) but it only gives you 4% per annum, it may be earning the spread of 11%. You may be unhappy with the fact that the government is getting in a sense a low interest 'loan' to make its investments, but the fact is that Singaporeans as a whole keep quiet and do nothing to change the status quo.

Now, you might say, many people do not have time to look after their savings investments and are willing to let someone else who knows what they are doing, manage it for them.

How about those who have the time to manage their investments? Perhaps an option is to make the CPF an optional scheme. For those who want to opt into CPF, the government will be responsible. For those who want to opt out, they will have to be responsible for their own retirement. But this is a political issue.

Or perhaps, we could retain the compulsory nature of the CPF, but instead of forcing Singaporeans to contribute 20% of their salaries, they should only be required to contribute less, like maybe 10%. This is a number that is closer to other countries' pension funds, like the Canada Pension Plan. This, again, is a political issue.

We could even ask another question and say, I'm not sure that the CPF is giving me as much money as I should be getting. I think the government should be more transparent about the CPF and the returns it is getting so we can figure out if we deserve more. But transparency is a political issue.

The issue about how much returns can the government give on our CPF monies is a economic issue. But the question, should CPF be compulsory and/or should we have the freedom to manage more of our retirement monies and give less to the CPF, is a political one. The question whether the govt should be transparent with their books, is a political one.

And as long as the politics of the CPF remains as it currently is, there is no point arguing that the government should be giving more than 4%. Because as long as Singaporeans abdicate their rights to manage their own retirement money, the returns on the CPF are not for the people to decide, it is for the government to decide.

I think the real issue ultimately boils down to whether the people want to be spoon fed and let the govt take the responsibility for their retirement, or they want to take responsibility into their own hands. i.e. without solving the political issues of the CPF, it means very little to debate over the economic ones.

Sunday, September 09, 2007

Finance Companies: Hong Leong Finance, Singapura Finance, Sing Investments & Finance

Previously, I did a comparative analysis of the 3 big banks, DBS, UOB and OCBC. In this note, I compare the three savings and loans companies, Hong Leong Finance, Singapura Finance and Sing Investments & Finance.

Previously, I did a comparative analysis of the 3 big banks, DBS, UOB and OCBC. In this note, I compare the three savings and loans companies, Hong Leong Finance, Singapura Finance and Sing Investments & Finance.

The finance companies are similar to the big banks in the sense that like the banks, they take in savings deposits on the liabilities side and make mortgage, auto and other loans on the assets side. Meanwhile, they earn the spread between the two interest rates.

However, finance companies are much smaller than the big banks and do not provide many of the other fee-based services that the banks provide. As a comparison, DBS had $2b in net interest income for HY07 while Hong Leong Finance only had $85m in net interest income for the same period. In other words, DBS had 23.5x the net interest income of Hong Leong Finance. At the same time, fee-based services are virtually non-existent for Sing Inv and Singapura Finance compared to the big banks.

However, finance companies are much smaller than the big banks and do not provide many of the other fee-based services that the banks provide. As a comparison, DBS had $2b in net interest income for HY07 while Hong Leong Finance only had $85m in net interest income for the same period. In other words, DBS had 23.5x the net interest income of Hong Leong Finance. At the same time, fee-based services are virtually non-existent for Sing Inv and Singapura Finance compared to the big banks.

The small size of the finance companies can make it difficult for them to compete against the big boys. They have much smaller networks and retail outlets and fewer services to cross sell to their clients. In addition, they have a much weaker marketing power (and budget) than their bank counterparts.

However, what they lack in size they make up in other ways. For instance, Hong Leong Finance is part of the larger Hong Leong group which includes City Developments, a major real estate developer. Hong Leong Finance is able to market its mortgage services through CDL when the latter launches real estate projects. As for the other smaller finance firms, they would have to compete based on the better and more personalized service that they offer to small customers than the big banks normally would.

However, what they lack in size they make up in other ways. For instance, Hong Leong Finance is part of the larger Hong Leong group which includes City Developments, a major real estate developer. Hong Leong Finance is able to market its mortgage services through CDL when the latter launches real estate projects. As for the other smaller finance firms, they would have to compete based on the better and more personalized service that they offer to small customers than the big banks normally would.

Financial & Profitability Analysis

The table below helps to crystallize the comparison between the finance companies.

Non-recurring and non-core items such as gain on sale of investments/PPE and rental income have been shifted below the operating income line in order to make comparison of core activities more accurate.

As we can see, HL Fin is the largest of the three, by quite a stretch. Meanwhile, S’pura is the smallest. HL Fin has quite a significant portion of income coming from fee and commission income, such as corporate finance and wealth management, while the other companies have little.

In terms of interest margin, Sing Inv appears to have the worst margin of 38.67%. This is very small compared to the others which average about 51%. If Sing Inv can manage its balance sheet so that its interest margin is comparable to its peers, then it will be able to see a significant surge in profit.

In terms of balance sheet management we can see that S’pura Fin has a much smaller liabilities/assets than its counterparts. This means that there is still significant space on its balance sheet to make more loans to increase its interest margin.

In terms of ROA we see that HL Fin is the best performer. This is due to the fact that it has a much greater fee income that does not tie down the balance sheet. In the meantime, Sing Inv has the lowest ROA, and is probably because it has the lowest interest margins, as mentioned above. However, Sing Inv could see marked improvements in its profitability if it can manage its interest margin to match its peer group.

Valuation

Valuation-wise there seems to be nothing suspicious if you expect the HY07 performance of the three companies to perpetuate into the future. A case can be made, however, that Sing Inv is undervalued if it is able to manage its balance sheet and improve its interest margins. For more information on this idea, check out this post on KLEER’s blog.

I will investigate the idea in more detail in a later research note.