Uni-Asia Finance Corp is a recently-listed finance and investment company with operations in

The structured finance income is derived from transactions that the bankers assist in advisory and origination and is akin to investment banking revenue. The ship investment income is income from the company’s investment in ships. This portion of income, which is a significant portion (56.6% in FY 06) of the company’s income, has very similar economic characteristics to shipping trusts. The distressed assets investment income is somewhat in common with the structured finance investments of the Babcock & Brown structured finance fund. All in all, Uni-Asia operates primarily as an alternative assets investment manager with structured finance investment banking income.

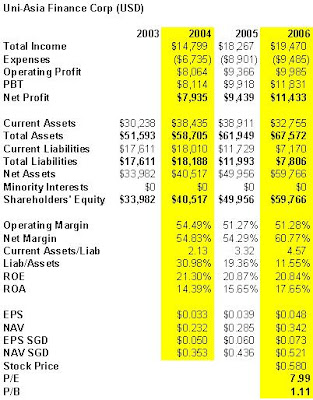

Financial & Profitability Analysis

The table below lists the FY results of Uni-Asia from 2004 thru 2006.

The numbers for Uni-Asia are not too far from a comparable, Westcomb financial. The P/E of the company seems reasonable and P/B is conservative.

The P/E of the company seems reasonable and P/B is conservative.

At the current moment it is difficult to do a comparative analysis between the latest results of Westcomb and Uni-Asia as the latter has not released HY07 results. So I shall keep an eye on this company and do deeper analysis later in the year when results are released and the post-IPO numbers give a better springboard for analysis.

4 comments:

Thanks for introducing this stock to me !

Based on what the prospectus says, the firm is targeting a payout rate of 50%. Checking out your EPS of $0.073 and assuming a share price of $0.60 ( in SGD ). We're talking yields of 6.08%.

This looks very yummy to me. If only we can calculate the free cash flow to see if this 6% is sustainable. ( CFO looks like payout is sustainable )

Do correct me if I'm wrong about this because I'm close to putting my money where my mouth is.

( 88% for Financial Statement Analysis ! You should be teaching the CFA program. I don't think anyone in my masters class in NUS can get a score like that. )

Regards

hi, my calculations concur with your yield analysis.

however i have not delved into the sustainability or quality of the cash flow of the company.

a FCF valuation would take a while to do.

Urgh ! Looks like I may have to give it a miss.

2006 :

Operating cash flow $1146

Purchase of fixed assets ($838)

FCF blunt estimate $308

Dividends given out was $1400. ( I've ignored the down-payment for a ship which will make results look worse. ) Looks like the company was giving some cash back to shareholders before the IPO.

Cash flow from investments don't look too good either.

It was a lot better in 2005.

Guess I'm not smart enough to figure out where the moo-lah is supposed to come from.

Post a Comment