Overview

Of the three,

Of the three,

Nevertheless, it is currently partnering with Hong Kong Land (subsidiary of Jardine Matheson) and Cheung Kong Holdings (controlled by Li Ka Shing) to develop two of the newest and sexiest commercial developments, the Marine Bay Financial Centre and One Raffles Quay. On the residential side, Keppel has recently launched several upscale projects such as the Reflections at

Wing Tai Holdings is somewhat smaller than Keppel, but large nevertheless in terms of absolute revenue. It is a player mainly in the residential and hospitality markets. The group’s operations have mainly been in

GuocoLand is a subsidiary of Hong Leong Group Malaysia, run by billionaire Quek Leng Chan, cousin of Kwek Leng Beng.  Its developments tend to be condominiums in the residential areas in

Its developments tend to be condominiums in the residential areas in

Competitively, Wing Tai’s and Guoco’s market positioning is slightly different from the Keppel/CDL/CapitaLand group which focuses on large scale mega projects. On the other hand, Wing Tai and Guoco compete mainly in the mid to upper-tier residential market with condos and smaller upscale developments.

As is widely known, the macroeconomic environment is favourable overall, with many property players seeing large upside revaluations on their assets and a healthy environment with which to launch their new projects. This favourable environment is seen by most to be able to sustain itself for the mid-term future in all the key markets in which the businesses compete:

Financial Statement Analysis

In terms of disclosure, Keppel Land is far and away the most transparent and analyst-friendly. And considering that it is only their HY07 financial results, this is quite remarkable. Keppel provides a lengthy Management Discussion & Analysis of the operating environment, as well as detailed segmental reporting. The other two companies provide less of such information in their FY07 report. It is presumed that more information will be disclosed in their respective annual reports.

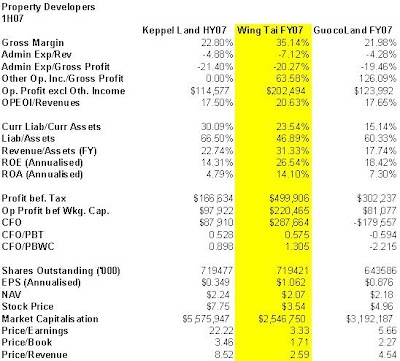

The table below displays the comparative Jun 07 results for the three companies. Wing Tai and GuocoLand report FY07 results in June. These are compared against Keppel’s HY07.

It should be noted that both Wing Tai and GuocoLand have registered significant gains due to revaluations in assets. The recording of revaluation gain in the income statement is brought about by the adoption of the accounting standard FRS 40. Prior to this standard, revaluation gains were recorded directly on the balance sheet as other comprehensive income. The earnings presistence of these gains is comparatively low and should not be treated as core income.

Just as for the property majors, I use an adjusted number, operating profit excluding other income, in order to adjust for the property revaluation income. The OPEOI/Revenues are more comparable, with Wing Tai registering a few percentage points higher in this margin. It is also notable that Wing Tai employs significantly less leverage than the other two developers.

Valuation

In terms of valuation, it can be seen than the P/E and P/B of Wing Tai is much smaller than its peers. This is probably due to large revaluation gains it has registered. Also, it could be due to the smaller pipeline of projects that Wing Tai has, compared to the mega projects of Keppel. The balance sheet space for additional leverage could indicate that Wing Tai does not have as many projects as it could have, in order to maximise the utilization of its balance sheet.

Guocoland is priced somewhere in the middle.

It is difficult to say if any of these companies are over or undervalued, without a deeper and more detailed financial analysis of the development pipelines of the respective companies. Nevertheless, this overview is sufficient to give an overall feel for this segment of the industry and how it operates.