Uni-Asia Finance Corp’s share price has flown into the stratosphere in the last couple of weeks. I previously did some research on the stock in early September. Since then, from trading around $0.60 it has soared to nearly $2 in about two weeks.

Uni-Asia Finance Corp’s share price has flown into the stratosphere in the last couple of weeks. I previously did some research on the stock in early September. Since then, from trading around $0.60 it has soared to nearly $2 in about two weeks.What in the world is going on?

The company’s recent HY07 results reveal a 91% jump in net profit. There has been a significant year-on-year jump in both investment income and fee income. However, the Management Discussion & Analysis reveals that a large portion of the increase in income was due to the one-time launch of the Akebono Fund and the one-time disposal of three vessels. In other words, the market seems to be treating the one-time profits as recurring.

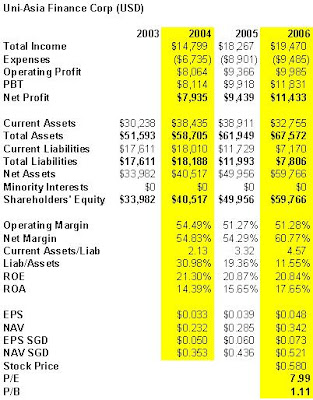

The images below, extracted from the latest HY report, illustrate. (Click for full image)

Up, up and away......!!!