| Wilmar Int | Golden Agri | Indo Agri | First Res | Kencana Agri | |

|---|---|---|---|---|---|

| Return on Equity | 18.43% | 11.96% | 17.16% | 24.97% | 13.17% |

| Return on Assets | 9.75% | 8.88% | 10.92% | 16.68% | 9.07% |

| Return on Capital Employed | 18.68% | 9.43% | 17.29% | 23.55% | 11.48% |

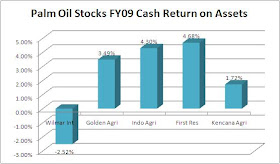

| Cash return on Assets | -2.52% | 3.49% | 4.30% | 4.68% | 1.72% |

The numbers in the above table are visually depicted and analysed below:

The Return on Equity ratio measures the rate of return on the ownership interest (shareholders' equity) of the common stock owners. It measures a firm's efficiency at generating profits from every unit of shareholders' equity (also known as net assets or assets minus liabilities). ROE shows how well a company uses investment funds to generate earnings growth.

In terms of FY2009 performance, the ranking of the 5 palm oil stocks on ROE, from best to worst, is as follows:

- First Resources

- Wilmar International

- Indo Agri

- Kencana Agri

- Golden Agri

Return on Assets measures how profitable a company's assets are in generating revenue. This number tells you what the company can do with what it has, i.e. how many dollars of earnings they derive from each dollar of assets they control. Return on assets gives an indication of the capital intensity of the company, which will depend on the industry; companies that require large initial investments will generally have lower return on assets.

Return on Assets measures how profitable a company's assets are in generating revenue. This number tells you what the company can do with what it has, i.e. how many dollars of earnings they derive from each dollar of assets they control. Return on assets gives an indication of the capital intensity of the company, which will depend on the industry; companies that require large initial investments will generally have lower return on assets.In terms of FY2009 performance, the ranking of the 5 palm oil stocks on ROA, from best to worst, is as follows:

- First Resources

- Indo Agri

- Wilmar International

- Kencana Agri

- Golden Agri

Return on Capital Employed is used in finance as a measure of the returns that a company is realising from its capital employed. It is commonly used as a measure for comparing the performance between businesses and for assessing whether a business generates enough returns to pay for its cost of capital.

In terms of FY2009 performance, the ranking of the 5 palm oil stocks on ROCE, from best to worst, is as follows:

- First Resources

- Wilmar International

- Indo Agri

- Kencana Agri

- Golden Agri

Cash Return on Assets measures the Cash Flow from Operating Activities in relation to Total Assets. Cash Return on Assets basically shows how well (or how poorly) the company is generating cash from its asset investments. Similar to Return on Assets, the company hopes to generate as much revenue as possible from its assets.

Cash return on assets can fluctuate significantly from period to period due to changes in working capital management. It is best to observe the trend of the CROA over time in order to get a better idea of how the company is performing with regards to its ability to generate cash flow from its assets.

In terms of FY2009 performance, the ranking of the 5 palm oil stocks on CROA, from best to worst, is as follows:

- First Resources

- Indo Agri

- Golden Agri

- Kencana Agri

- Wilmar International

In terms of the overall profitability performance, based on the financial analysis above, the rankings of the 5 SGX palm oil listed stocks is as follows.

- First Resources - First resources has consistently outperformed the rest of the pack in every measure. There is no debate that this company is the top performer relative to the rest of the group.

- Indo Agri - Despite coming in behind in ROE and ROCE to Wilmar, Indo Agri grabs the 2nd spot because of its superior performance in ROA and much better Cash Return on Assets. Wilmar international appears to have pipped Indo in ROE due to more aggressive leverage numbers.

- Wilmar International - strong all round performance marred by poor cash flow management.

- Kencana Agri - consistently underperformed the top 3 but consistently outperformed Golden Agri

- Golden Agri - reasonable cash flow performance but low profitability all around.

No comments:

Post a Comment

All comments will be moderated. Please be patient if yours does not appear immediately.